Expense reporting software is designed to automate the entire expense management process, from the submission of claims all the way to analyzing business expenses.

A reporting software solution like this is an essential component in expense management. It is mainly used by small- and medium-sized businesses as well as large enterprises to handle various aspects of their accounting and company finance functions.

Expense reporting software solutions come in different varieties, from standard single-entry apps designed for basic tasks like check writing and bookkeeping to more advanced double-entry systems that provide users with more sophisticated features and capabilities. In fact, many expense reporting applications normally come with full-featured expense management software solutions as a key function.

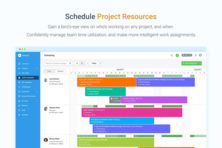

Avaza provides a free expense reporting solution that gives one user access to up to five active projects with expenses, timesheets, invoicing, and resource scheduling capabilities.

Avaza provides a free expense reporting solution that gives one user access to up to five active projects with expenses, timesheets, invoicing, and resource scheduling capabilities.

The adoption rate of expense reporting software solutions is at an all-time high. But even with their immense popularity in the world of business, nearly half of company personnel, business travelers, off-site employees, and field reps still choose to fill their pockets, wallets, and briefcases with receipts and other financial documents which they then have to staple together and submit to accounting departments for validation and records keeping.

On the accounting and/or finance department’s side, managing and assessing every single company expense report to ensure policy standards are met can be tedious and time-consuming. Finance officers have to double-check and confirm the appropriate GL codes and enter the correct data into the company’s accounting system. This process is often repeated dozens of times every month.

Admittedly, even with expense management and reporting software solutions at their disposal, a lot of people still fall right back into their old ways, the painful and inefficient process requiring manual labor and tremendous effort.

If you are a company facing this kind of situation, either you have off-site employees and field reps or if you want to refine and streamline the processes of your accounting/finance department, you may want to consider pushing the many different features and capabilities of free expense reporting software, especially if you’re still hesitant to invest in paid software solutions that you might end up not fully utilizing.

Fully equipped expense reporting and management software helps automate policies, which empowers managers and employees as the expense reporting and tracking process becomes a lot easier and more efficient.

Users can use the software to create as well as manage expense codes based on the company’s preferences. Many expense reporting software systems also allow for the handling of multiple currencies and tracking of exchange rates, which is beneficial for businesses with employees who frequently travel.

One of the many aspects of running a business where expenses can quickly blow up is in project development. Without complete control over project costs and expenses, you may end up going over your budget.

Free expense reporting software solutions like Avaza, Zoho Expense and Expensify—which allow users to gain complete control over their expenses—are available. Avaza’s mobile-centric design, for instance, enables users to create expense reports and manage receipts from virtually anywhere, using any mobile device with internet connectivity.

The platform provides real-time visibility into project expenses while also allowing expense tracking in any currency and providing expense reports in the user’s preferred currency.

Many expense reporting software solutions allow users to easily append billable expenses to invoices and other pertinent information like taxes and markups. Avaza has an automatic currency conversion feature, allowing users to add/update expenses to invoices quicker and more accurately.

Assigning fixed pricing and/or percentage-based increases to expense categories is also possible with several free expense reporting software systems, not just the paid platforms. You may also categorize expenses on invoices when billing your clients. You can add sub-totals on invoices to provide a clearer picture for your customers.

Full-featured expense reporting software offers the kind of functionality that most businesses and organizations will find very useful when it comes to their accounting and finance management. But for a small- and medium-sized business, as well as startups, investing financial resources on paid expense management and reporting software can be difficult and scary.

Many of the functions that one might find in a paid expense reporting software, such as inventory and invoicing capabilities, are available in a number of free expense reporting software like Zoho Expense, Avaza, and Expensify.

One of the more obvious benefits of opting for a free software solution is the absence of an upfront investment. SMBs can simply use the software without worrying about where to get the financing for the application or trying to justify the cost of the software investment and determining the ROI. Many free expense reporting software systems are quite feature-rich, especially systems like Avaza, which boasts powerful expense reporting, accurate client billing, and integrated project expense management, among other things.

Another benefit of using expense reporting solutions like Avaza, Zoho Expense, and Expensify is the fact that systems like these can help minimize the occurrence of expense fraud. This is usually when an employee charges the company for an expense that is not at all business-related. Expense reporting software keeps records of employee expenses as well as provide managers and authorized personnel real-time expense tracking.

Expense reporting software also provides decision-makers and stakeholders deep, actionable insight into the expenditures of the company. This will allow businesses to carefully analyze how they’re spending their finances, which is especially crucial to SMBs and startups with limited resources.

The ability to perform expense/spend analysis can provide businesses and organizations with usable data as to the trends and patterns of their spending. This will ultimately help companies make wiser spending decisions and minimize unnecessarily wasteful expenses.

Finally, expense management and reporting software helps to minimize the risk of costly errors, especially when billing clients or calculating expenses like travel, project development, and so on. With a system that keeps accurate and up-to-date accounting records and other pertinent expense data for the entire organization, costly errors may be avoided.

Free expense reporting software is an inexpensive approach to fully switch from the traditional spreadsheet and physical pen-and-paper method of expense recordkeeping to a more accurate and efficient web-based system. Expense reporting software is more effective in reducing costly errors, minimizing expense fraud, and keeping all expense records accessible to managers and decision-makers.

The bottom line is that employees tasked with traveling for business, field reps, and offsite workers can keep accurate and comprehensive records of their spending without keeping a ton of paperwork to accompany their spending claims. Managers and department heads can obtain employee expenses and invoicing information anytime they want, from anywhere, using their mobile devices.