If you’re managing a small company, you might think you don’t need an accounting solution. However, manually calculating the financials in your business can prove unwieldy. This outdated method can lead to miscalculations. When there are errors in your systems, it can negatively impact the entire workforce. To avoid this scenario, business owners turn to accounting software. With these platforms, you can streamline tasks and activities related to accounting, invoicing, receipts, payments and payroll.

Wave is a free accounting software with no hidden charges and artificial limits on the features it offers. You can have a business platform that fuses invoicing, receipt scanning and accounting into a single solution. Its easy-to-navigate dashboard allows users to view all important information at a glance and access powerful features to simplify the accounting process.

Wave Features

Here are the top features Wave offers:

Accounting

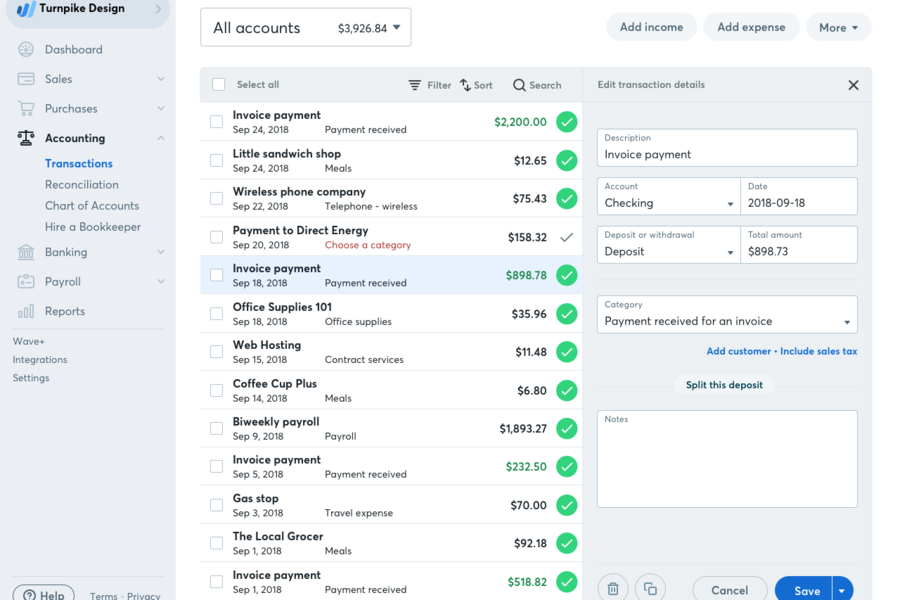

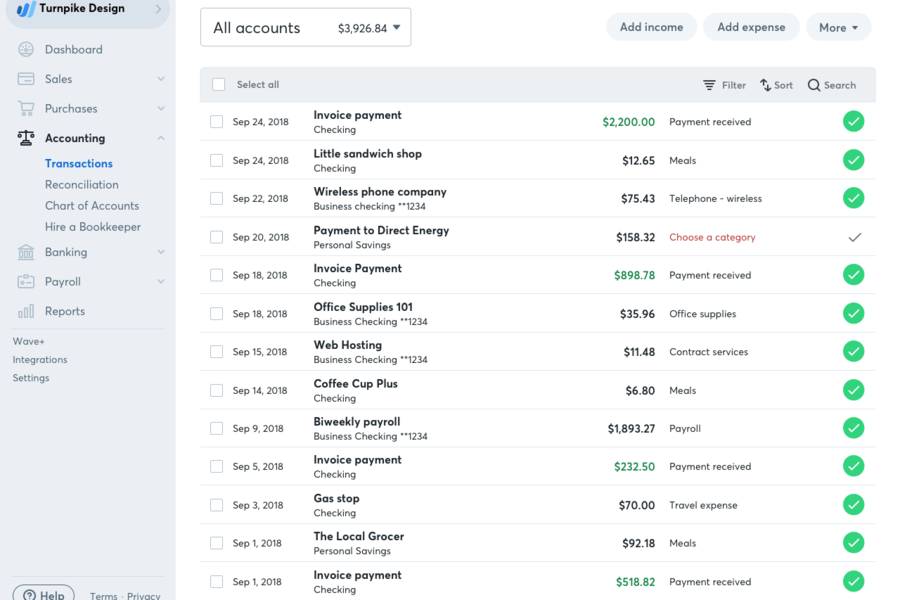

The tools found under Wave’s accounting category offer a simple, reliable and secure interface that easily manages cash flow and prepares you for tax season. It has an easy and fast setup process that requires no training and technical expertise. This is suitable for beginners and entrepreneurs. You’re given an intuitive dashboard that connects unlimited bank and credit card connections and lets you view sales, purchases, accounting, banking and reports on a single screen.

Other accounting features include:

- Unlimited income and expense tracking

- Unlimited bank and credit card connections

- PayPal, Shoeboxed, and Etsy connections

- Instant updates for invoicing, payroll and payments data

- Bill and invoice reminders

- Customizable sales taxes

- Automatic exchange rate calculations

- Customizable expense and income categories

- Search transaction descriptions

Invoicing

When it comes to invoicing, Wave lets you create free professional invoices. It’s quick, customizable and unlimited. If you don’t have your own templates for invoices, you can use what Wave already has. You can also set up recurring billing for repeat customers. This saves up time and effort in chasing their payments.

Other invoicing features include the following:

- Invoice in any currency

- Follow-up statements

- Credit card and bank payment options

- Logos and colors can be added

- Easy-to-understand cash flow insights

- Automatic sales tax calculations

- Automatic backup in the cloud

- Customizable payment terms

Payments

In receiving payments from your customers, you can expect to get pain in as fast as two business days with additional fees as low as 1%. This makes it easier for customers to pay you since you’ve given them both credit card and bank payment options. Wave also automatically tracks your invoices and payments straight into the accounting records. You never have to worry about missing an important deposit or payment. With this, you’ll also be prepared for tax season.

Payroll

Payroll is one of the most important features to keep track of. It needs to be accurate and exact, especially since this directly affects your workforce. Wave lets you run payroll within minutes and guarantees 100% accuracy regarding your records. With this functionality, you can pay employees and contractors their expected dues in an accurate and efficient fashion. Wave also lets you do automatic fillings and payments and directly puts them into your journal entries.

Receipts

Receipts should always be managed properly. Once you lose them, it can be detrimental to your records. But with Wave’s receipt tracking, you don’t have to worry about losing any of it. It works by letting you scan receipts anywhere using the mobile application on your phone, review the information before approving it and syncing them into your accounts.

Wave Benefits

The top benefits of using Wave include:

Accounting made easy

Manual accounting is one of the biggest headaches business owners experience daily. Keeping track of receipts, chasing after payments and issuing invoices are difficult to do without the proper system. Not to mention, it’s error-prone and requires manual data entry. This can cost you several hours. This negatively impacts your business.

But with Wave, accounting is made easier. You can track and monitor everything with ease. It also provides you with data-driven insights to manage your income and expenses.

Professional templates

Having your own invoice lets other people know you’re a reliable company. Wave gives you the ability to create and send professional invoices. You can even choose from their selection of templates. Just add your own logo and colors and then you have your own, personalized invoice.

More payment solutions

Constantly reminding and chasing after customer payments is a stressful experience to endure. But with Wave’s payment solutions, you can give your customers more options to settle their dues. With this feature, you get faster payments and better cash flow. For customers who want to pay online, this is helpful as they can receive invoices and pay at once.

Wave Pricing

Despite Wave being free, some of its features require payment. In line with this, its pricing is split into free, pay-per-use and monthly. The latter options are catered primarily for online payments and payroll requirements your business might need.

Free

Wave is completely free. This means users can enjoy all the features related to accounting, invoicing and receipts. It doesn’t have any set-up fees, hidden charges or monthly fees. Under accounting, you are given unlimited options for the following: bank and credit card connections, income and expense tracking and guest collaborators. You can also run multiple businesses in a single account.

The next feature is invoicing. This lets you issue invoices in any currency, send estimates that can be turned into invoices once approved and personalize invoices according to your preference. You can also get paid faster with the help of Payments by Wave. However, additional fees can apply.

The third feature, receipt scanning, allows you to get unlimited receipt scanning with the free iOS and Android applications, capture receipts and automatically record receipts as accounting transactions.

Pay-per-use

The pay-per-use option is catered primarily for online payments. If you want to process credit card transactions and bank payments, you are expected to pay a small amount. Credit card processing has a fixed percentage of 2.9% + 30 cents per transaction and takes two business days to complete.

For bank accounts, a $1 minimum fee is charged per transaction. This type of transaction takes 2-7 days to process.

Monthly

When it comes to payroll management, you can expect a monthly base fee of $35 for tax service states. This includes California, Florida, Illinois, New York, North Carolina, Tennessee, Texas, Virginia and Washington. Additional fees include $4 per active employee and $4 per independent contractor paid. Through this feature, your payroll taxes are expertly handled by Wave.

If you want self-service states, you can expect a monthly base fee of $20 for the other 41 states not previously mentioned. Additional fees include $4 per active employee and $4 for every independent contractor paid. This simplifies the filing process for payroll taxes.

Conclusion

For starting businesses and entrepreneurs, a fully functional accounting department isn’t feasible. This can be caused by tight budgets and a small workforce. The best solution to address this would be through an accounting software solution. Across all financial software solutions, Wave is one of the top options for small companies.

With powerful features that allow for custom invoices, sales tax, receipts, accounting reports, sales tax reports and payment methods, Wave gives users the luxury of having streamlined operations and automated tasks. These tools and functionalities are designed to save time, reduce manual data entry and simplify the whole income and expense tracking.