Stripe is a cloud-based payment platform created to help businesses of all sizes in accepting and managing online transactions. Nowadays, people are relying on software solutions as a better and effective alternative to bookkeeping. It requires less paperwork and effort in tracking and managing your financial requirements.

Furthermore, Stripe is used by businesses of every size, from new startups to public companies. Since most people make use of online transactions, this software solution makes it easier to collect credit cards and process payments. It also offers a powerful and flexible toolkit for your business. Features related to payments, billing, connecting and payouts are offered to the users are catered to address each crucial stage of your payment process.

Stripe is a relatively inexpensive credit card processor. For a small price per each successful charge, you can conduct online business effectively and efficiently. Other than being able to collect payments and issue invoices, users can also build their own e-commerce environment using Stripe’s API. You can partner with the platform’s many e-commerce associates.

Stripe Features

Payments

Stripe offers several payment methods, which include, but is not limited to, MasterCard, Visa, Discover, Google and Apple Pay:

Stripe elements

This refers to a custom UI toolkit catered for merchants and business owners to build their own custom payment forms.

Embeddable checkout

This method allows you to customize an embeddable payment form for the devices within your website.

In-person payments

Even though it’s not Stripe’s ideal payment method, users can still accept payments in person. This is done through a series of mobile card readers and terminals. Additionally, Stripe gives you development tools to create your own POS integration.

Invoicing

Invoicing lets you send custom invoices and request payments from customers. This includes ACH payments. Additional features include the ability to create recurring, usage-based, scheduled, promotional and tiered payments for your audience.

Stripe Sources

The Sources API offered in Stripe makes it easier to accept payment methods from customers around the globe. Using only a single integration, users can enjoy supported payment methods. This includes Giropay, Bancontact and Alipay.

Billing

This feature lets you use a new set of tools to build and scale your business model. You can integrate faster and bill your customers with one-off invoices or automatically with the recurring ones. Other tools include building blocks, hosted invoices, smart recovery tools and automatic invoice reconciliation.

Connect

This feature simplifies and accelerates your daily operations that include user onboarding, reporting, pay-in and pay-out networks and compliance. It automatically tracks your financials for you by connecting multi-party payments into a single, centralized solution.

Payouts

Stripe lets you send mass payouts to sellers, service providers and freelancers across the globe. It does this by automating workflow payouts and handling onboarding processes.

Atlas

As one of Stripe’s most advanced features, Atlas allows you to start your own company from the ground. This is done through a series of steps, which Atlas guides you through. You can create a legal framework for your company by completing the following:

- Forming a legal entity

- Opening a bank account and a debit card

- Forming bonds with the Stripe Atlas Community

- Setting up a Stripe account

Radar

Radar is a helpful feature that prevents fraud and security breaches. It does this through Machine Learning and frictionless authentication. This reduces the risk of blocking legitimate customers who want to reach out to you.

Issuing

Stripe Issuing is designed to create, distribute and manage physical and virtual cards. It features an API for creating cards and new business models. This gives you more control over certain aspects in your company such as spending limits and entire card stacks.

Terminal

Even though Stripe is used primarily in the online world, it has certain features to assist in the physical one. With Terminal, users can build their own in-person checkout. This also means being able to unify online and offline channels with the developer tools Stripe offers.

Stripe Benefits

Customized check-out experience

Stripe allows you to create and customize your ideal check-out experience. Businesses and companies have different steps when it comes to checking out products. With the help of the UI toolkit, you can build and personalize your business’ front-end, design and analytics. It also means being able to embed checkout on your sites and integrate it with the mobile site.

Several payment methods

One of the reasons why Stripe is highly popular among merchants is because of its international reach. With varied payment options, businesses can process and accept payments from all major credit and debit cards in every country. Other options also include Alipay, Apply Pay and CheckOut.

Optimized reports and insights

If you want to check your overall finances, you can rely on Stripe’s report generation feature. You’re given access to all types of reports that include real-time information related to each charge, fee and transfer in your business. Additionally, you can view relevant data based on specific aspects such as currencies, countries, payments, and types.

Secured payment processing

Because Stripe deals with several merchant and customer accounts, security is one of its top priorities. It protects your money by optimizing routing paths using direct integrations with major card networks and using additional layers of authentication to secure against fraud and data breaches.

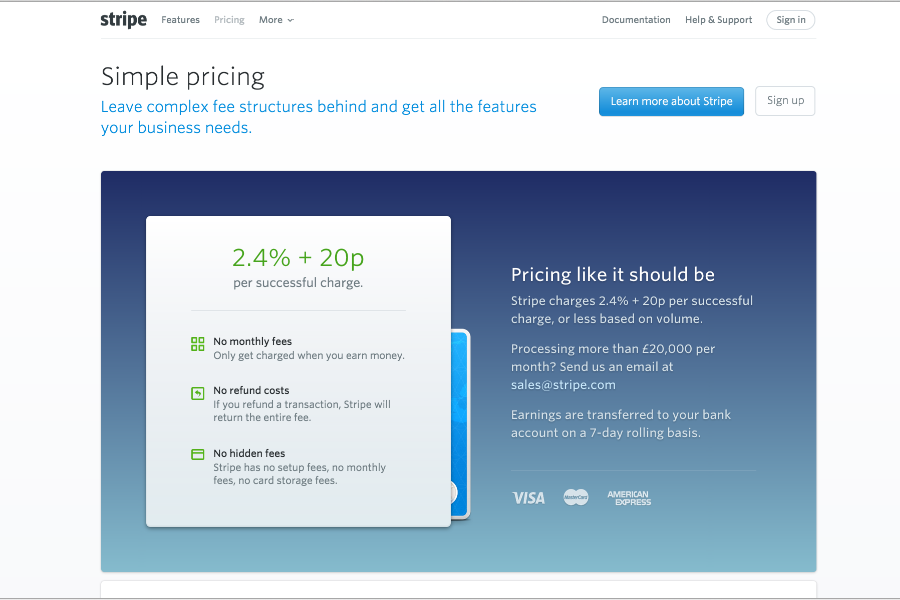

Stripe Pricing

Stripe is split into two simple pricing packages. It doesn’t have a fixed monthly price like most software solutions. Instead, its price range is completely dependent on how frequently you use Stripe. With this requirement, Integrated and Customized are catered to two different business sizes.

Integrated is catered for small to mid-sized businesses. Users can access a complete payments platform with simple, pay-as-you-go pricing. For 2.9% and 30 cents, each successful card charge, you get to experience Stripe with all its features and functionalities. This includes being able to manage payments, have updated features and expect no fees of any kind. This means no set-up fees, monthly fees and hidden fees.

On the other hand, the Customized plan is a custom package for businesses with large payments volume or unique business models. This plan comes with volume discounts, interchangeable pricing, multi-product discounts and country-specific rates.

Users get to experience more than 100 features in the pricing plans. This includes the tools to build optimized checkout flows, global payments with a single integration, financial reconciliation and reporting and comprehensive security.

However, users should note that the more advanced features in Stripe come at a price. For example, Sigma’s features start at 2¢ per charge and Atlas costs a one-time $500 payment.

Conclusion

Stripe is a platform engineered for growth. You can set up a marketplace online, which gives you several advantages in certain aspects. You get to bill customers on a recurring basis and accept payments from different bank options and currencies. This gives you an all-around global platform to support electric transfers of money from an issuing bank and into an acquiring bank.

Known for its industry-leading developing tools and varied payment methods, Stripe is one of the most popular payment gateway platforms in 2019. Since it handles money daily, it often reviews your account and processing habits routinely. This poses a problem for some people because they often find their funds being held against their will. Sometimes, Stripe even cancels accounts showing suspicious activities. But overall, it only goes to show that Stripe is serious in providing security in all accounts.

Stripe is generally recommended primarily for mid-sized to large businesses. It’s also perfect for companies dealing with technology since it offers developer tools. With its advanced features and simple API, Stripe is easy to work with and perfect for people who just want a reliable and high-quality credit card processor.