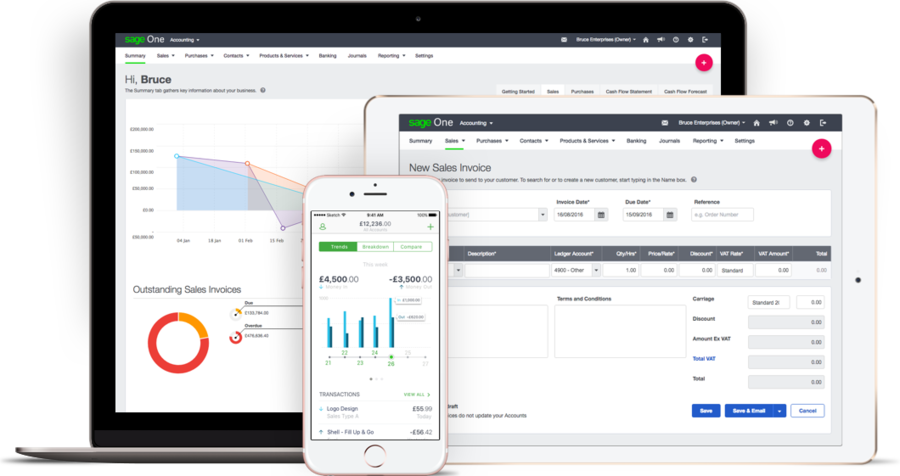

Sage Business Cloud Accounting is a cloud-hosted accounting software solution that is SSL-secure and is designed with small to medium-sized businesses in mind. It is accessible on desktops, laptops, and mobile devices. It tracks the flow of cash coming in and out of the company. The software has dashboards, graphs, and other visualizations that offer users an overview of their business, as well as providing income and expense tracking. With Sage Business Cloud Accounting, users are able to manage payment documentation and processes. The software product also ensures all pertinent accounting data is readily accessible.

The company website has a knowledge base, blog articles, and how-to videos. Users are also able to readily make use of the company’s customer support by contacting a representative. Sage Business Cloud Accounting is compatible with over 30 currencies around the world, although expectedly numbers and values might change depending on the country the users and their customers are located in.

Sage Business Cloud Accounting Features

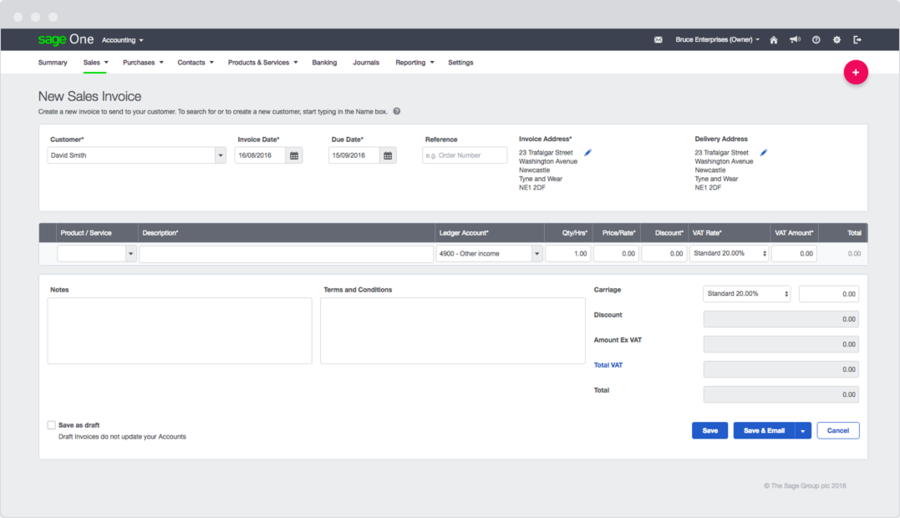

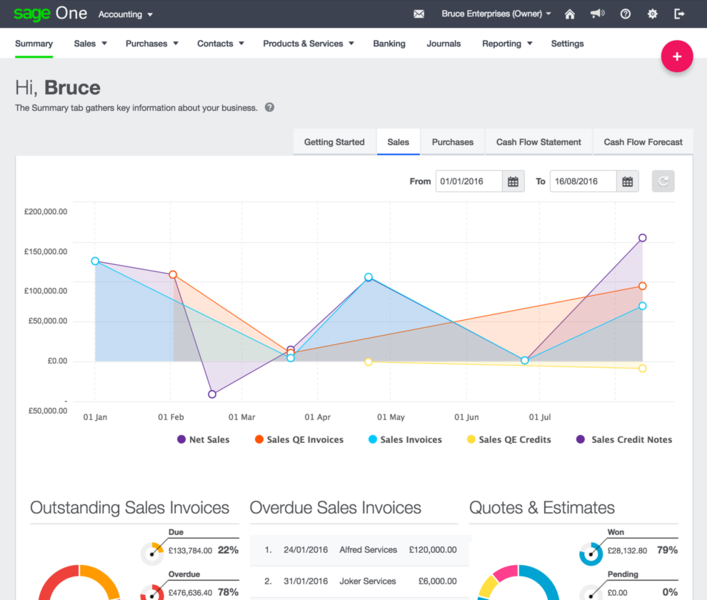

Sage Business Cloud Accounting manages both invoices and accounting data, and also offers expense management, compliance management, as well as project accounting. The software product enables users to keep accounting data accessible from a single platform, which keeps them updated. Forecasting of cash flow is one of its features that enables users to create cash requirement estimates using transaction history as a basis. Users also have the ability to create estimates and quotes and then convert them into invoices. Sage Business Cloud Accounting also has templates for both product and service-based invoices and is customizable in that users can imprint their company logo on the invoice. Credit card and bank accounts may also be synchronized for clarity and coordination.

Sage Business Cloud Accounting allows users to manually enter billable time and expenses to invoices. They are also able to track bills, manage vendors, and input data about their inventory. This information can include pricing, description, and categories. Users are also capable of running multiple financial reports for business analysis. Mobile applications for both iOS and Android are available, where users are able to create invoices, view performance graphs, and record expenditures. The system also integrates with some third-party software and programs, and users are able to give customers the option to pay online. Sage Business Cloud Accounting also enables users to track how much customers owe at a glance. Leveraging this, users are also able to notify customers of this and chase overdue balances.

When starting out with Sage Business Cloud Accounting, users need to enter contact information and then the “Getting Started” summary screen will guide them through setting up a Sage Business Cloud Accounting account. In the settings section, users will need to input important preferences like invoice settings, navigation, and email customizations.

The user interface is divided into tabs. These tabs are summary, sales, expenses, contacts, and others. The tabs are different depending on the pricing plan the user has gone with.

In summary, there are numerous tabs labeled “Sales,” ”Expenses,” ”Cash Flow Statement,” and “Forecast”, among others. Each of these tabs contains a dashboard with real-time graphs and charts about the business. The invoicing software product also has many default settings available and emails can be automated for many different uses. Default terms and conditions, as well as notes, can be set to appear on each invoice, which can either be sent via email or printed. Templates are also available for both service-based invoices and product-based invoices.

Sage Business Cloud Accounting differentiates between estimates and quotes. However, both documents can contain default terms and conditions, and estimates may also be converted into invoices. The software also has a contact management section where users can add contact information as well as notes on the customer. Sage Business Cloud Accounting also allows users to set default tax rates as well create credit limits for each individual customer.

Sage Business Cloud Accounting allows users to add items by service or product as well as put in information such as product description, default tax rate, code, sales and expense accounts, price, and comments. Vendor bills can also be added to the software. Bank statements and credit card statements may also be imported, or if the user needs it, a live bank feed is provided instead and Sage Business Cloud Accounting also recalls any past transaction categorizations.

Sage Business Cloud Accounting is also able to analyze sales, expenses, journal entries, and bank transactions. Users can then personalize categories as needed. The software is also able to get sales taxes for the user depending on the address but also add as many additional tax rates as necessary.

Sage Business Cloud Accounting Benefits

Sage Business Cloud Accounting is a comprehensive accounting solution that has many features that ease the load on the users. It makes getting paid faster because customers have the option to pay directly through the sales invoice. Sage Business Cloud Accounting also connects to the user’s bank and credit card accounts, and because of this transactions are easily synced. As a result, the software is able to reduce time on manual data entry and gives a real-time view of important financial activity.

From a single platform, users are able to create and manage tasks for their team, as well as share and access files, review dates, and estimates. Subsequently, users are able to monitor the progress of cash flow and make the whole process more efficient. Users also have unlimited access to support where they can talk with a live agent in case any concern does pop up. As it is a cloud-hosted software, Sage Business Cloud Accounting offers continuous backup solutions and eliminates the need for any installation.

Sage Business Cloud Accounting Pricing

Sage Business Cloud Accounting offers two pricing plans both of which offer a 30-day free trial period. After the period, however, users will need to choose a payment plan. The first enterprise package is called Accounting Start. This package has a bevy of features that include sales invoicing, bank synchronization, insights, and reports in the form of balance sheets, sales tax calculation, cash flow tracking, check printing, mobile applications, and cash accounting. This plan only allows for one user, and it costs $10 per month.

The second payment plan is called Accounting, and it costs $25 per month. This, however, comes with the ability to register multiple users and the option to choose either cash or accrual accounting. Aside from all the other features that Accounting Start offers, this package has cash flow forecasts, quotes and estimates, vendor bills, as well as the ability to track, record, and control movement of stocks.

Conclusion

Sage Business Cloud Accounting manages all the processes and documentation needed in business payments such as estimates, statements, quotes, and invoices. This software allows integration with banks, which allows users to import all payment transactions automatically. All information is put into one platform and enables users to stay updated on the cash flow of their company. It takes a load off of the users, especially small to medium businesses, who don’t necessarily have the resources needed to have a team of highly efficient accountants.