Braintree is a cloud-based payment processing gateway designed to simplify and optimize how businesses and companies accept payments from their customers. It comes with global commerce tools, an easy-to-navigate user interface and security features.

People can make use of this software solution to reach a larger audience and drive higher conversion rates. It works primarily with PayPal but it also works well with Venmo (only in the US), credit and debit cards, Google Pay and Apple Pay.

Not only does it make it easier to accept payments, especially with multiple services, but it also boosts sales revenue as Braintree has a global reach. It offers innovative payments technology, white-glove support and scalable options.

Braintree helps strengthen business operations, bundle up products and services in comprehensive packages and provide seamless customer experiences in the checkout zone.

Braintree Features

The core features of Braintree help organizations process payments and better optimize how payments are handled. These include:

Anti-fraud tools

Protect all payment transactions with Braintree’s anti-fraud tools such as risk thresholds, AVS and CVV. You can minimize chargebacks, reduce friction and lessen false positives. Developers claim that you can expect a 60% average reduction rate in terms of losses and a 50% reduction of false positives.

Data security

Braintree is complete with popular security features such as data encryption, activity monitoring and session management. This platform is also a Level 1 PCI-compliant payment gateway, ensuring all transfers and transactions are protected.

Payment methods

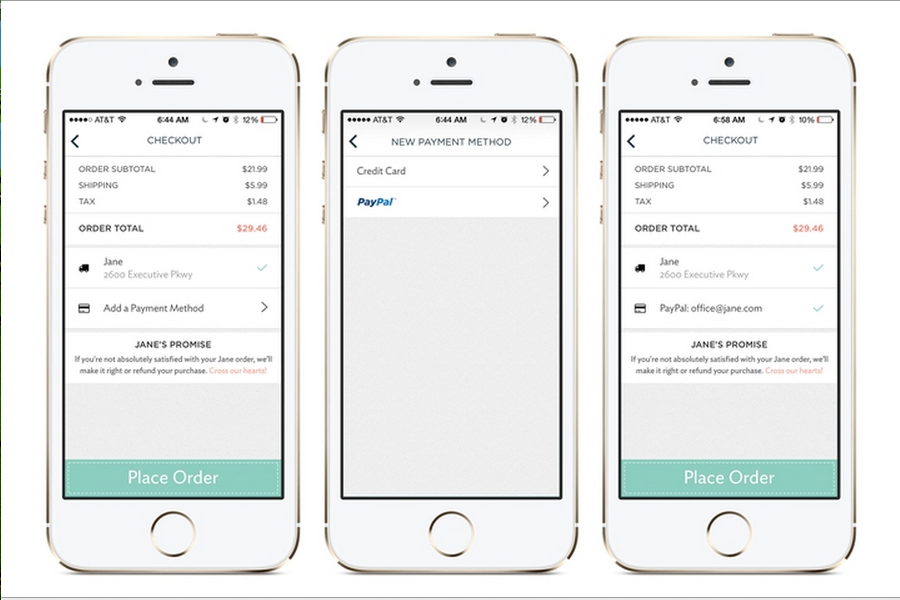

Having been acquired by PayPal, it’s not surprising that Braintree offers customers a payment gateway that lets them access the world-renowned online payments system along with other similar services such as Venmo and other credit and debit cards. Now, your customers can pay however they want.

Reporting

This software solution allows you to generate reports and gain insightful data regarding your transactions. Here, you can keep track of everything with the help of powerful features such as dispute management, advanced transaction search, Webhook notifications and settlement batch summary.

Global scale

You don’t have to limit your payment methods in a single location. With Braintree, you can extend your reach to more than 45 countries and regions. You can work with local banks that will help you set optimized acceptance rates. You can also benefit from diverse payout options and seamless integration methods.

In-store payments

Other than providing businesses with multiple payment methods, you can also benefit from in-store payments. Here, you can use point-of-sale tools, which allow you to create in-store experiences. This includes online appointments, retail locations, pop-up stores and branded events.

Braintree Benefits

The reason why people choose Braintree to handle and process their payments is highlighted in these main benefits:

To drive conversion

People don’t want to sign up with companies that make it hard to pay for products and services. Now with Braintree, you can create seamless payment experiences, improve customer retention and provide popular payment methods. This also ensures customers can pay however they want, which increases sales revenue and offers the highest-converting digital wallet.

To increase efficiency

When your payment needs are taken care of, you can better focus on managing your core business and finding ways to improve your sales revenue. Braintree’s entire platform is designed to reduce integration costs, automate business processes and meet the standards for PCI compliance. Additionally, you can set up recurring billing and subscriptions so you don’t have to do it manually every time a customer returns..

To expand global reach

Once subscribed to Braintree, you’re open to newer and more innovative ways to reach more people and sell more products. It’s designed to assist in accelerating growth, finding new revenue streams and unlocking partnerships with other organizations. It does this by giving access to more than 200 markets, 130-plus currencies in multiple countries and regions.

To mitigate risks

Money is no laughing matter. Companies and organizations need to secure all payments transferred to them. With Braintree, you can expect powerful features and tools that will protect you against fraudulent transactions, secure sharing options regarding payment data and simplifying PCI compliance. Overall, this platform helps in building an ecosystem of trusted partners and ensuring sensitive data is protected at all times.

Braintree Pricing

Here is an overview of the products and pricing packages Braintree offers:

Products

Braintree offers the following products:

Braintree Direct

This is a product through which users can easily and quickly process online payments. It features a simple payment processing platform, where everything you need to sell your products online, can be found. You’ll access popular wallets such as Apple Pay, Venmo, PayPal, Google Pay and more.

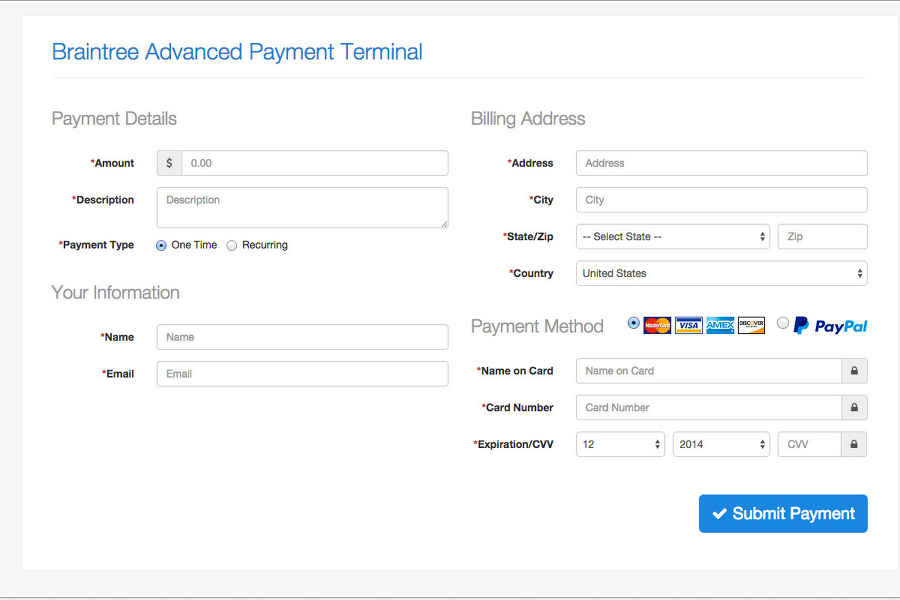

You can also work with different checkout options, such as a drop-in UI, which is easy to implement for payments, or a custom one, which makes the checkout flow unique but also addresses PCI compliance validation. You can choose which option best fits your business.

Braintree Extend

Braintree Extend refers to a product offered by Braintree that lets you do more with payment data. It features a flexible set of data-sharing functionalities and tools that are designed to secure connections and manage your overall business. It works through a series of simple steps that empower your channels with seamless payments.

Braintree Auth

Using Braintree Auth, you can allow merchants to interface their Braintree account to your platform, giving you the necessary permission to hand them value-add services, such as analytics and invoicing. What this does is reduce the tedious minutiae business owners and managers have to deal with.

Braintree Marketplace

Considered as a scalable payment solution, Braintree Marketplace provides businesses with combined pay-in methods, such as bank payments, cards and online wallets. It offers a robust list of other capabilities that include the ability to detect fraud and control chargebacks.

Braintree Pricing

Braintree has two basic pricing plans to choose from—standard and custom.

Standard pricing

The first pricing follows a formula of 2.9% + $0.30 per transaction. You don’t have to worry about meeting minimum standards, paying monthly fees and getting charged for hidden fees.

With this plan, you get to benefit from basic fraud tools, merchant account and a payment gateway, data encryption, reporting, recurring billing, third-party integrations and integration support.

Custom pricing

The second plan doesn’t have fixed pricing. Instead, it’s completely customized to your business needs. It’s also tailored according to your volume and business models. Just contact the sales team via call, email or submit a form to get the custom quotes.

Conclusion

Braintree is an online payment solution, complete with powerful features and easy-to-navigate global commerce tools. With this platform, businesses and organizations are open to merchants in more than 40 countries and 130-plus currencies.

You can choose between a drop-in UI and a custom one for your payment options. Other than providing you with effective tools to work for your system, you can also expect heightened security measures to protect all sensitive data being transferred from one system to the other.