CardPointe is a cloud-based payment processing and payments portal for businesses. It is the flagship payment solution of CardConnect, the premier payment processing and technology solutions provider based in Pennsylvania, USA. The complete platform effectively combines a couple of crucial functions in the retail business: a payment gateway and a virtual terminal.

The platform allows businesses to easily integrate, manage and process credit card payments. It is equipped with a full suite of robust products such as a plug-and-play retail terminal, a virtual terminal, a hosted payment page, a mobile application and device. CardPointe is also designed to seamlessly integrate with third-party mobile processing systems and conventional countertop terminals, effectively expanding its usefulness outside of the eCommerce sector.

With CardPointe, businesses are able to process both credit and debit card payments, as well as e-check (ACH) transactions. The cloud-based platform provides users access to their accounts 24/7, and it features in-depth transaction data, PCI compliance, product catalogs, real-time reporting, a comprehensive customer database and support for recurring billing.

In addition to managing your business’s credit and debit card transactions, CardPointe also gives you the ability to efficiently perform key tasks such as setting up bill plans and managing Payment Card Industry Data Security Standard (PCI DSS) compliance by simply taking the PCI Self Assessment Questionnaire. All transactions that you process with CardPointe are safe and secure, as they are protected by CardConnect’s patented tokenization and PCI-validated point-to-point encryption (P2PE) service.

CardPointe Features

CardPointe is touted as “the complete platform for businesses,” allowing for simple and secure integration, processing and management of payments. The truth of the matter is CardPointe does possess most of the features and functions you would need, as a business owner, to accept credit card, debit card and e-check payments. The following is a summary of some of the core features the platform has in store for small and medium-sized businesses (SMBs):

Merchant accounts

The merchant account feature is available to all CardConnect business clients. Merchant accounts are provided through First Data, giving businesses the ability to manage credit and debit card transactions, as well as ACH or Automated Clearing House payments.

There are additional merchant account options available to merchants that belong in the high-risk category. It should be noted that all merchant accounts are equipped with a built-in payment gateway, thus making the platform a suitable solution for most e-commerce businesses.

Merchant transaction management system

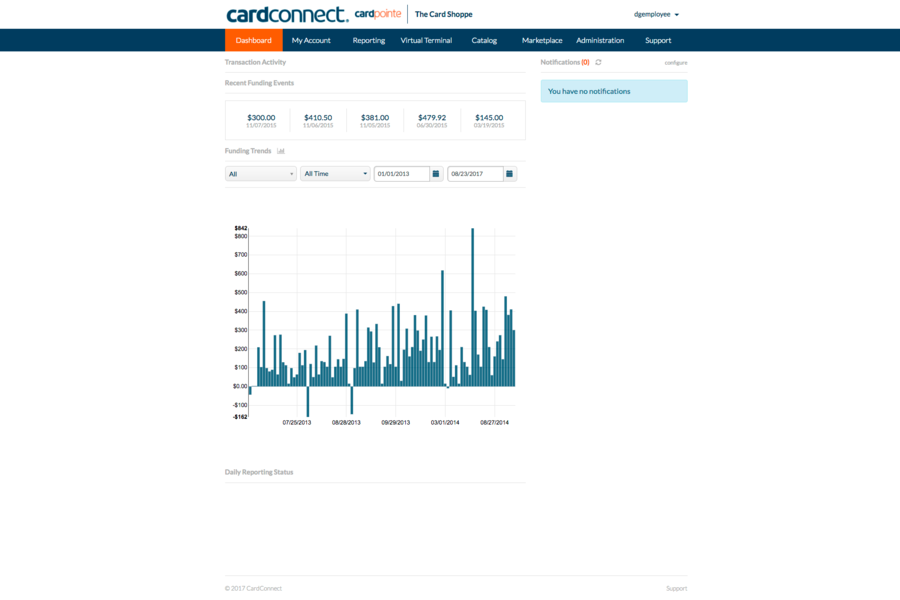

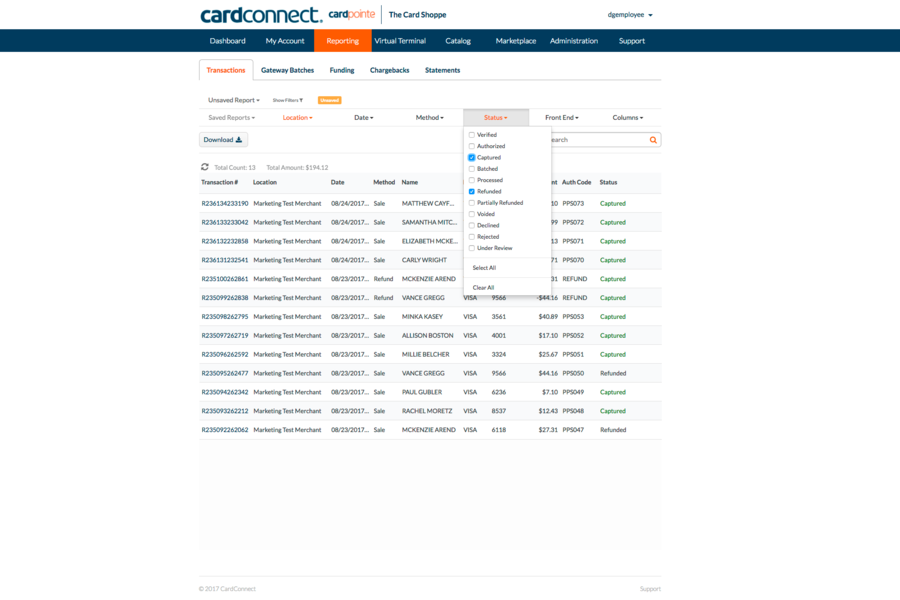

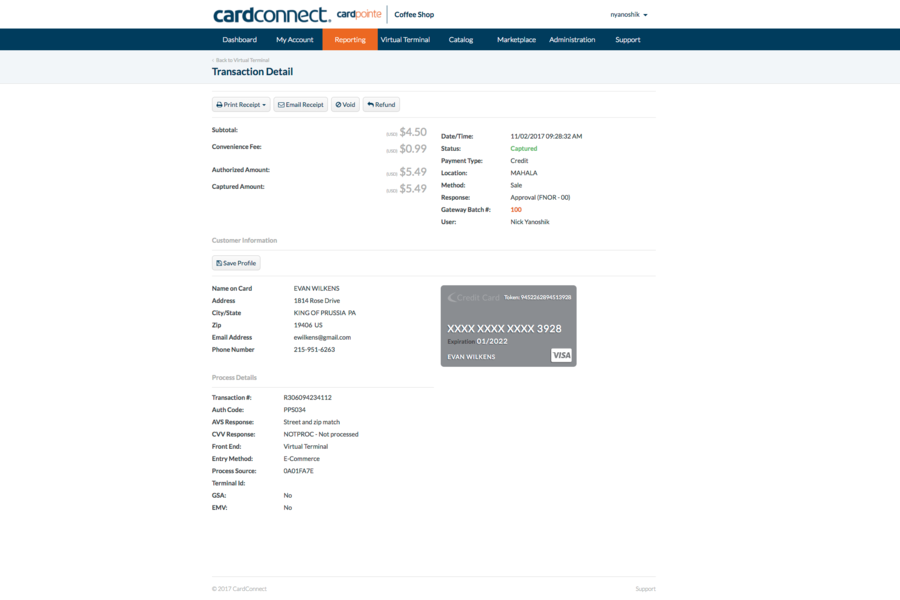

CardPointe’s merchant transaction management solution is provided as a desktop application that enables merchants to get a high-level overview of all their company’s payments and transactions in real-time. Using the application, merchants have the power to manage their PCI compliance requirements, set recurring payments, edit product catalog, create customer profiles and parse sales data all from a single platform. It is also the app they use for conducting refunds, voids and reprint receipts.

The platform utilizes the Trustwave Single Sign On (SSO) service to enable merchant users to complete their PCI questionnaire and PCI initiatives from within their CardPointe account. Merchant transaction management supports iOS and Android devices through a mobile credit card processing app, which means users can carry these features over to their tablets, smartphones and other mobile devices.

Countertop credit card terminal

CardPointe is designed to fully integrate with many different types and models of countertop credit card terminals, which are available through the CardConnect store. The store carries a wide variety of EMV-ready plug-and-play terminals, including the Ingenico iCT220 and the Ingenico iCT250. Both models come with P2PE security and are capable of accepting both chip cards and magstripe modes of card-present transactions. However, only the latter model (iCT250) supports contactless payment processing.

CardConnect’s CardPointe credit card terminals are equipped with Tip Adjust and Server ID settings, which make them suitable for spas, salons, restaurants and other similar businesses in the hospitality sector. The product is also designed to automatically facilitate PCI compliance by making sure all customer information and other sensitive data remain secure and never touch the business’s systems.

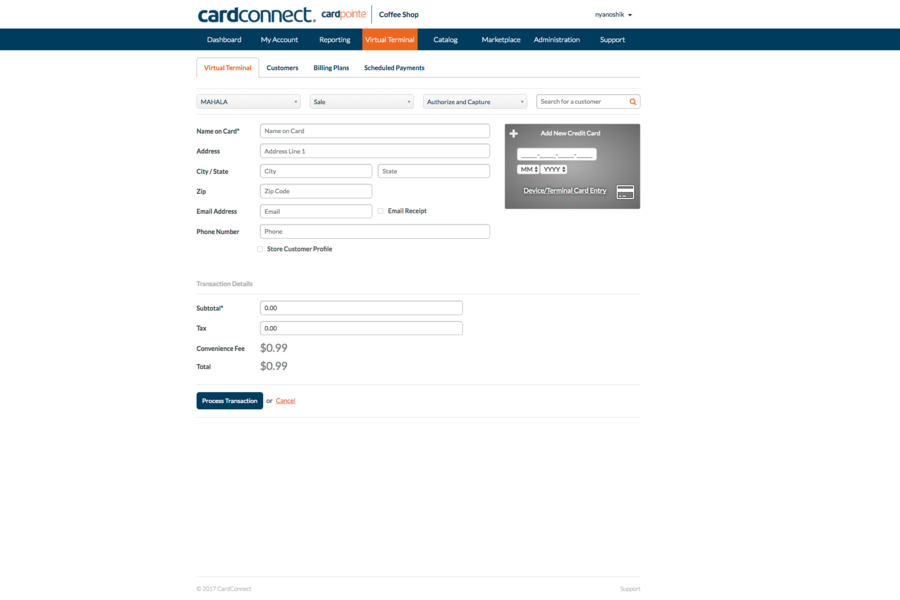

Virtual terminal

CardPointe also offers a virtual terminal, a browser-based point-of-sale (POS) system that runs on your desktop device and is designed for processing cardless transactions. It is a complimentary feature that comes with your CardPointe account.

Similar to the countertop terminal, the virtual terminal software also features robust P2PE and tokenization. It supports seamless integration with various countertop credit card processing units with keypads, so it’s not only suitable for cardless transactions but it also allows you to easily key-in credit card information for card-present payments.

CardPointe’s virtual terminal software is compatible with a number of credit card processors, including Ingenico iPP 320, Ingenico iPP 350, Ingenico iSC Touch 250, ID TECH SecuRED and ID TECH SREDKey. All of these products are available at the CardConnect store.

Mobile credit card processing app

The CardPointe mobile credit card processing app serves as an extension of the transaction management system and the full CardPointe platform. The app is free to download via Google Play for Android or the Apple Store for iOS devices for quick, secure and on-the-go payments processing. It works seamlessly with a mobile card reader for processing card-present payments and offers the same features and capabilities as the desktop version.

Using the app, businesses can easily label, price and organize their products with the Catalog tool for quick and effortless checkout process. The transaction management system that comes with the app is optimized for mobile use, making the process of filtering and generating reports easier and more efficient. The app is also designed to make it easier for users to go into every transaction to complete specific actions such as refunds and voids.

Hosted payment page (HPP)

The CardPointe hosted payment page or HPP gives eCommerce merchants the ability to custom build their own checkout page within their business website. The HPP feature is directly integrated with CardPointe’s payment gateway and is protected by CardConnect’s CardSecure solutions. It comes with tokenization, invoicing and recurring payments setup option.

CardPointe HPP is one of the most ideal eCommerce solutions available for online stores and merchants, allowing them to deploy a user-friendly and customizable payment page that fully complements their branding.

CardPointe HPP boasts a quick and simple setup process, requiring no developer or IT personnel involvement. It is specifically tailored for non-technical users and users with little to no coding experience. Just like the virtual terminal feature, CardPointe’s hosted payment page is also offered as a complimentary feature with any CardPointe account.

Integrations and add-ons

CardPointe supports some of the most commonly used POS systems, eCommerce shopping carts and accounting software. With your CardPointe account, you will have the ability to integrate with a plethora of third-party software solutions to help you manage your business. Several add-ons are also available, including different analytics tools and the option to acquire a Clover POS system through First Data.

CardPointe Benefits

CardPointe is designed with simplicity, security and efficiency in mind. Being that it is the flagship product of CardConnect, it’s not at all surprising that it comes with myriad features and capabilities specifically tailored to meet the needs of SMBs, eCommerce businesses and online merchants. With this cloud-based platform, you can integrate, manage and process credit card payments in the simplest and most secure way possible.

Easy to use platform

CardPointe’s transaction management system is pretty straightforward and simple to use. People with no experience using this kind of software solution or anything like it should have no trouble getting familiarized with the system in record time.

Robust and feature-packed software solution

CardPointe is one of the most feature-rich payment processing solutions available in the market. With this platform, you get a software solution that can do more than its core functions. For example, the CardPointe Hosted Payment Page lets you build a fully customized payments page for your eCommerce website. It allows you to track past transactions and it integrates with a wide variety of third-party systems.

Security and compliance

CardConnect appreciates the value of security, especially when it comes to eCommerce, so it’s not surprising that its flagship product, CardPointe, features a built-in P2PE and tokenization to protect sensitive business and customer data. The best part is that these tools are also capable of seamless integration with other platforms. PCI compliance is another aspect of this platform that most business users and merchants will find truly beneficial.

Plug-and-play hardware

Another benefit to choosing CardPointe is the fact that most, if not all, of its hardware does not require additional software installation to work properly. Hardware like a credit card reader, for example, is so easy to integrate to the CardPointe system that all you really need to do is connect it to whatever device you’re using and it’s ready to go.

CardConnect Pricing

CardConnect has not provided any pricing details for CardPointe or any of its products or services. To acquire more accurate and up-to-date pricing information for any of CardConnect’s offerings, including CardPointe, you may contact the vendor directly by visiting the CardConnect official website.

Conclusion

CardPointe is a solid cloud-based payment processing platform. Whether you run a small- or medium-sized eCommerce business, an online retail store or a brick-and-mortar one, CardPointe has something in store for you to help you manage and grow your business in the easiest and most efficient way possible. There is a reason why it’s being marketed as “the complete platform for businesses,” CardPointe really does have a lot to offer.