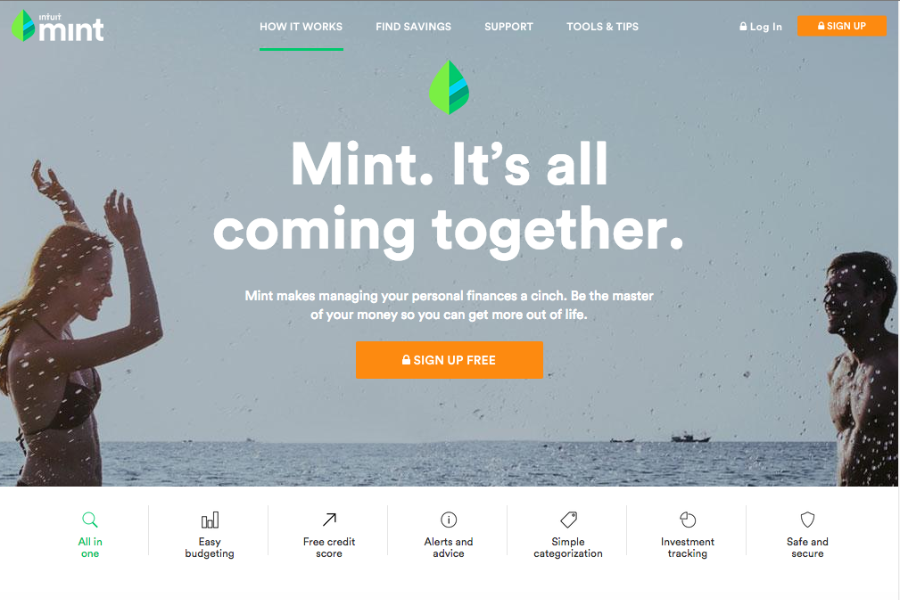

Mint is a budgeting and financing application suitable for both personal and business use. With its intuitive dashboard and management tools, you can see all your accounts, credit scores and balances in one screen. At a glance, you can stay updated and informed regarding your expenses and spending. It’s free, fast and easy with the ability to automate tasks and streamline operations. It only supports US and Canadian accounts, which is restrictive for people in other countries who want to try it out.

With Mint, you can integrate popular applications and platforms such as QuickBooks and TurboTax into the system. Other than tracking your expenses, Mint also provides you with optimization. You can compare your spending habits against the national average and use this information to leverage your money.

Overall, Mint is completely free catered for iOS and Android operating systems. Its budgeting style is category tracking with reporting tools that can manage your spending, income, debts, assets and net worth. On the other hand, its investing tools help in performance analyzation, allocation, value and stock market comparisons. You can also enjoy automatic alerts and reminders which comprises of email and goal reminders.

Mint Features

Mint has several powerful features all catered for easy budgeting and finance tracking. Once you set it up, financial data is seamlessly integrated into the system. The following are some of its top features:

Bill payment tracker

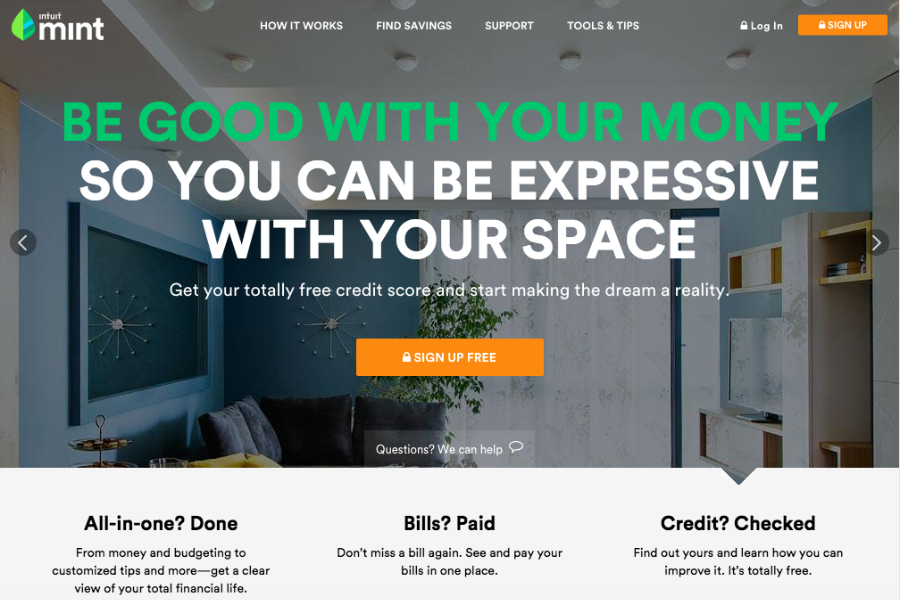

Since bill tracking is one of its core features, Mint provides users with an intuitive and effortless bill payment tracker. This is the place for you to view your bills at a single glance. Your bills can range from credit cards and rent payments to utility bills and other miscellaneous fees.

Staying on top of your bills and keeping track of your expenses is critical in ensuring timely payments. Mint lets you track and take care of your financial obligations from a single screen. Once you’ve paid for them, you can mark them accordingly. This eschews the need to log into different sites and memorize your passwords for all of them.

Other capabilities include bill reminders, low funds, bills due alerts and unusual spending notifications.

Budgeting

With this feature, you can categorize and calculate your spending based on your preferences. Set your expected price ceiling for each week or even each day. This helps to drastically reduce your spending to just the necessities. Mint also lets you create budgets that you can stick to and helps you set achievable goals. This helps in planning for both one-time and recurring monthly expenses.

When it comes to budgeting, you can also view your daily or weekly expenses. This gives you an idea of which part of your daily living costs the most and cut down on those said expenses. At the end of the month of the year, you’ll know what’s left of your money.

Free credit score

A credit score is one of the most critical aspects people need to watch for when spending their money or paying for their bills. This shows your credit worthiness in society. The higher your credit score, the more likely you’ll be able to ask for loans from the financial institutions.

Mint gives you reports on your credit score quickly and efficiently. Just verify your identity and then you’ll have your report summary in less than a few minutes.

Alerts

Alerts, reminders and notifications can be found under this category. This lets you stay updated regarding your bills and your budgeting goals. This allows you to avoid any unnecessary fees and penalties because of not being able to pay on time. It also alerts you regarding ATM fees, over-budgeting and unusual spending.

Budget categorization

Budget categorization is a simple and easy to understand feature in Mint that lets you add tags and view details related to your budgeting. The platform also has hundreds of default categories that you can rename or recategorize for each transaction. You can now see your spending across all accounts and financial institutions at a single glance.

Mint Benefits

The top three main benefits of Mint are:

All-in-one finances

The most challenging part of keeping track of your expenses is finding them and organizing them in the first place. People spend a lot of money each day, whether its for travel, consumption or rent. Due to having plenty of financial obligations, it becomes easy to lose track of where your money goes.

However, Mint provides you with an all-in-one budget and finance to bring with you everywhere you go. After every purchase or payment, you can easily mark and add them to the system.

Budgets made simple

Other than staying on top of bills, you can also create comprehensive budgeting plans that you can easily follow through. You are also provided with suggestions from Mint on how to control your spending and ensure you stay within your weekly or monthly goal. You can plan and cut back on the more substantial expenses.

Security

The last thing you want to experience when handling your money is to get hacked. Mint eliminates this risk by applying extra security layers. Other than being created by trustworthy companies such as TurboTax and QuickBooks, Mint safeguards your account through a four-digit code and even Touch ID.

It also has multi-factor authentication that lets you add from which devices you can access your account. It sends a code or an SMS each time you log in from a new device. If there are any suspicious behavior regarding your spending, then Mint quickly informs you.

Mint Pricing

Compared to other budgeting applications or software solutions, Mint is completely free. It doesn’t even need to be installed since it’s accessible through a browser or mobile device.

Mint gives you two options—sign up online through its website or download its free mobile application. It’s available for both iOS and Android. With a simple intuitive application, users can now enjoy proper budget management and free credit scores.

Conclusion

Multiple budget and finance platforms already exist in the current market. They offer different ranges of functionality and scalability but most of them share similar features. Examples of these are features related to budgeting, online synchronization, device compatibility and mobile application. What makes Mint stand out, other than being completely free, are the powerful budgeting tools and security capabilities.

With this system, you can manage all your finances in one location. It also provides you with a user-friendly and web-based interface that can assist you in budgeting and investment tracking. It also has tools that allow you to synchronize your bank accounts. You can even have a free credit score tracking option, which simplifies viewing your credit score.

At the end of the day, staying on top of your money can be a challenge if you don’t have the right tools. But with Mint, you can keep track of your money and pay your bills on time as well. Also, with the security layers it provides, you don’t even have to worry about your financial data being leaked.