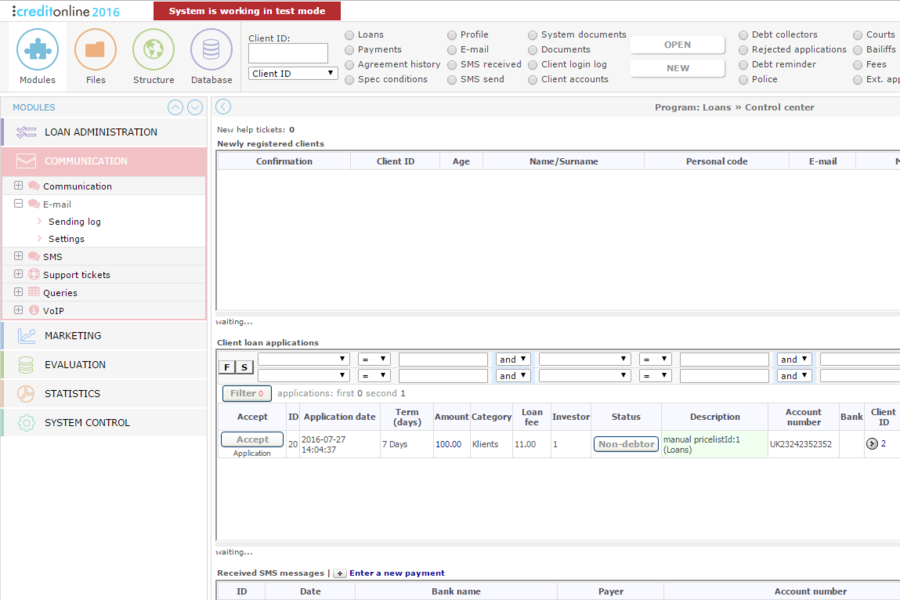

An overview of eGroup EU’s loan business management system CreditOnline

CreditOnline is a loan management system designed and developed by eGroup EU. It is a loan management software solution tailored to address various aspects of loan business processes.

The system is ideal for small- to medium-sized lending businesses, large-scale lending companies and investors who wish to have a robust and effective platform to facilitate certain areas of their lending business.

The developer, eGroup EU, specializes in building, integrating and supporting loan management systems for lending companies of various sizes. The company’s primary project is the loan business management solution, CreditOnline.

How CreditOnline works

eGroup EU is a European company and the CreditOnline system was initially developed by carefully assessing the best practices of the European loan market and its economical trends. But this doesn’t mean the features and capabilities of the loan management solution won’t apply to the needs of other lending companies in other markets.

CreditOnline has existed for more than seven years and throughout that time period, it has constantly been developed and supported. Today, CreditOnline is implemented in over 80 companies across the European Union, as well as in other countries.

As a loan management system, CreditOnline is equipped with a complete set of tools designed for almost every aspect of the lending business, including end-to-end loan processes. The solution offers 24/7 support and delivers fully automated loan life cycle process.

The software solution is created with multiple tools and services that effectively address the different challenges lending companies might face. Some of CreditOnline’s core features include:

- Web and mobile content management system

- loan management system

- Detailed consultations

- Virtual privacy service (VPS) hosting

- Full security package

- Full communication package

- Design and ergonomics

- Business analytics system (BAS)

- Advanced marketing solutions

- Credit history check with scoring

- Fully functional API solution

The benefits of CreditOnline loan management software

CreditOnline offers a wide range of service for various types of lending businesses, including consumer loans, payday loans, installment loans, secured loans and P2P lending. The system is developed to provide lending companies with a cost-saving and efficient solution.

The full business package

CreditOnline is not just a loan management software solution. It is packed with features and tools that transcend the solution’s full capabilities. The full business package allows users to:

- Get detailed consultations.

- Scale the software solution to meet company requirements.

- Obtain regular system updates.

- Initiate regular backups of system data and databases.

- Get the support they need 24/7 with direct monitoring of services.

- Get full training for employees on operating the lending business software.

CreditOnline API solution

The CreditOnline API solution is developed based on the latest IT and loan business technologies available. The solution paves the way for an economical and efficient growth and development of your lending business.

The API solution provides the following benefits:

- System integration – Take advantage of some of the best content management solutions in the market and implement it to your loan business solutions.

- Flexibility – The CreditOnline API solution is designed to be utilized along with a fully integrated Symfony framework environment, giving users the flexibility and efficiency they need to use other programming resources.

- Autonomy – Users can choose to manage their own development teams or hire programming experts and design agencies. Or, they choose to utilize the dedicated programming resources provided by eGroup EU.

Full automated process

CreditOnline is a fully automated loan management system. The solution helps to optimize the processes associated with the lending business, so you can be more productive and efficient in managing other aspects of your company.

The software solution also integrates easily with other third-party data service solutions. From data input and processing to validation, credit history checks, scoring and rating, CreditOnline helps to fully automate such procedures for maximum efficiency and security.

CreditOnline pricing plans

eGroup EU offers three CreditOnline loan administration software packages for different types of loan businesses. All pricing packages provide loan administration, communication, marketing, evaluation and system control features. You may also schedule a free demo for each of the packages.

Start Plan – Free license (support with API fee starting from $649.94/550€ per month)

- Control center

- Payments module

- Client profiles and accounts

- Agreement history and loan agreement history logs

- Reporting module

- Templates

- Notifications/reminders

- Email and SMS

- Databases

- Selection statistics

Standard License Plan – $2,363.43/2,000€ (support with API fee from $886.29/750€ per month)

- All Start Plan features

- Full loan administration

- Extension applications

- Solvency declaration log

- Send messages

- Client grouping management

- Address register

- Field constructor

- Electronic signatures

- Action log

Professional License Plan – $4,726.86/4,000€ (support with API fee from $1,063.54/900€ per month)

- All Standard Plan features

- Card types module

- Card token inquiry log

- Card tracking

- Payment type module

- Loan grouping management

- Export constructor

- API log

You may visit the vendor’s official website or contact their sales team directly for custom pricing and additional modules.

Conclusion

eGroup EU’s loan management software solution CreditOnline is a great system if you want a loan management platform that has all the right features and capabilities to allow you to maximize the efficiency and productivity of your lending business.

This is a serious investment though, especially for smaller companies. So make sure you check out the system and determine if it’s the right fit.